Succession Planning

Every Great Business Deserves a Future.

Plan Yours Today.

Succession planning is one of the most important and often most overlooked steps in securing the long-term stability of your business. Whether you’re thinking about retirement, exploring exit strategies, or simply preparing for the unexpected, it’s never too early to consider what comes next.

This page offers simple, practical tools to help you get started: a checklist, short videos from businesses who have explored options and chosen various succession pathways, and a directory of regional resources to help guide you through a successful transition.

Start planning your path forward with confidence.

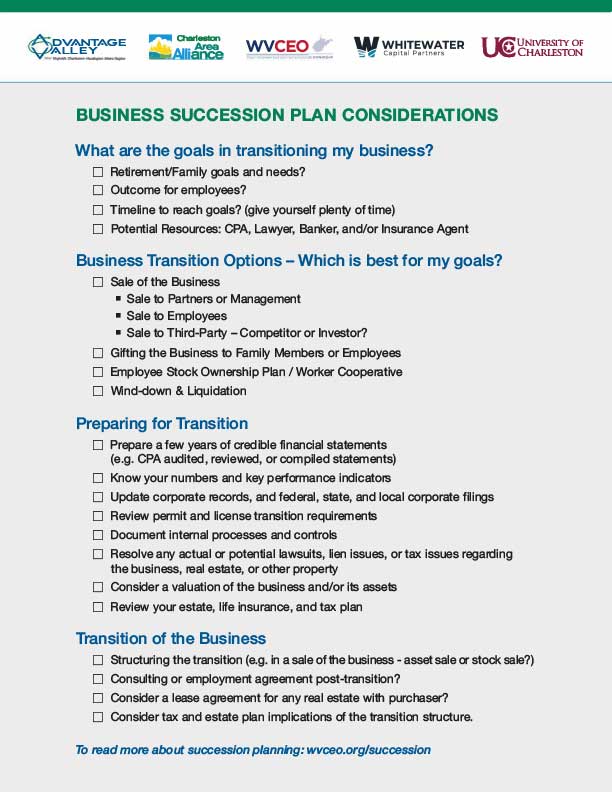

Click to Download Our Succession Plan Checklist

Planning for the Future:

Business Succession Options

Succession planning is one of the most important—and often most overlooked—steps in securing the long-term future of your business. Whether you’re thinking about retirement, exploring exit strategies, or simply preparing for the unexpected, it’s never too early to start thinking about what comes next. Advantage Valley is here to help business owners across our region better understand their options and connect with the resources they need to plan a successful transition.

There are several proven strategies for handing off your business while preserving its value, culture, and continuity. Below are five of the most common approaches, each with its own benefits depending on your goals, timeline, and company structure.

Real Stories of Business Succession in West Virginia

To help bring these strategies to life, we’ve partnered with local business owners who have experienced different succession pathways firsthand. In the videos below, you’ll hear from real people who’ve chosen four of the five common methods of transition: Management Buyout, Private Equity Buyout, ESOP Transition, Traditional Sale, and Generational Passing. Each video highlights a West Virginia business owner sharing honest answers to the most common questions—from why they chose their path, to what they wish they had known earlier.

Explore the stories below to gain insights, ask questions, and begin charting your own course forward.

Management Buyout

A management buyout allows your existing leadership team—those who already know the business inside and out—to purchase the company. This option helps ensure continuity and preserves company culture while rewarding loyal managers with ownership opportunities.

Mark Grigsby

Past President and Shareholder, Pray Construction Company

Interviewed by Tina McPhail

Executive Vice President, CFO, and Shareholder, Pray Construction Company

Private Equity Buyout

In a private equity buyout, an investment firm purchases your company—often with plans to grow or restructure it for resale. This option can offer a high-value exit and may keep you involved in the business for a period during the transition.

Adam Krason

CEO of ZMM Architects & Engineers

Interviewed by James Becker

Investor at Whitewater Capital Partners

Of Counsel at Lewis Gianola PLLC

Doug Ritchie

Founder of SDR and Star Plastics, LLC, Inc.

Interviewed by Vincent Centofanti

Director, Valuation, Forensic, & Litigation Support Services at Brown Edwards

ESOP Transition

An Employee Stock Ownership Plan (ESOP) lets you sell your business to your employees over time. It boosts employee morale and retention while giving you flexibility in your exit. ESOPs are ideal for owners who want to reward their team and preserve company values.

Keith May

President & CEO of IVS Hydro

Interviewed by Tim Gibbons

Executive Director, West Virginia Center for Employee Ownership

Traditional Sale

A traditional sale involves selling your business to an outside buyer, such as a competitor, supplier, or entrepreneur. This method can generate immediate value for the owner and is a good fit for those seeking a clean break or a faster exit.

Richard Sinclair

Former President, Jefferds Corporation

Interviewed by David Sayre

Senior Vice President of WesBanco

Generational Passing

Passing your business to a family member, often a son, daughter, or relative, is a common way to keep the company legacy alive. With proper planning, this method allows for a smooth transition and continued family involvement in the business’s future.

*Coming soon, a video about generational passing.

Planning for the Future:

Business Succession Resources Directory

Please be advised that neither Advantage Valley nor its partners endorse any of the following companies or resources. The information provided below is strictly for your convenience. You should always conduct your own due diligence regarding the effectiveness of any service provider.

Legal Services

West Virginia State Bar

Visit the webpage to search for a lawyer or use the Lawyer Referral Service. This is a way to find a lawyer currently taking referrals in specific practice areas using your location.

- Phone: (304) 553-7220

- Refer a Lawyer

Accounting & Business Valuation Services

West Virginia Society of Certified Public Accountants

Use the “Find a CPA Referral Service” to connect with member CPA firms in your location. For business valuations, seek professionals with CVA or ABV credentials.

- Phone: (304) 342-5461

- Find a CPA

Employee Ownership or Worker Cooperatives

West Virginia Center for Employee Ownership

Explore the journey of employee ownership. Reach out to Tim Gibbons for more information on how to start this path.

- Tim Gibbons, Executive Director

- Phone: (304) 357-4761

- Email: tgibbons@wvceo.org

- Learn More

Estate planning ensures the financial security of individuals and the smooth transfer of assets. Find professionals in your area through the following estate planning councils:

Greater Huntington Estate Planning Council

Charleston Estate Planning Council

Publications

Free Succession Planning Guide from the WV Center on Employee Ownership.